Is staying small the future for building software companies? What's the fundraising approach for founders in a world where building software is super cheap? And what does it mean for seed investing?

I've been talking to lots of founders, many repeat, and investors in the last weeks about the current dynamics on the fundraising market. You may have seen some takes on X and LinkedIn already. They come mostly from the VC perspective, so I wanted to offer a more comprehensive view starting with the founder perspective.

TL;DR? In short:

The reduced capital needs in early stages combined with current VC market dynamics will drive further concentration in pre-seed investing.

Founders now have the option to not raise early and raise later, or raise early and skip rounds. Both will create more valuation pressure on pre-seed rounds.

True small "angel" rounds are making a comeback.

Multi-stage and classic seed investors will be badly equipped to compete in smaller rounds because of ownership goals.

The value proposition of classic VC - "scale fast through hiring more" - won't resonate with many new-gen founders.

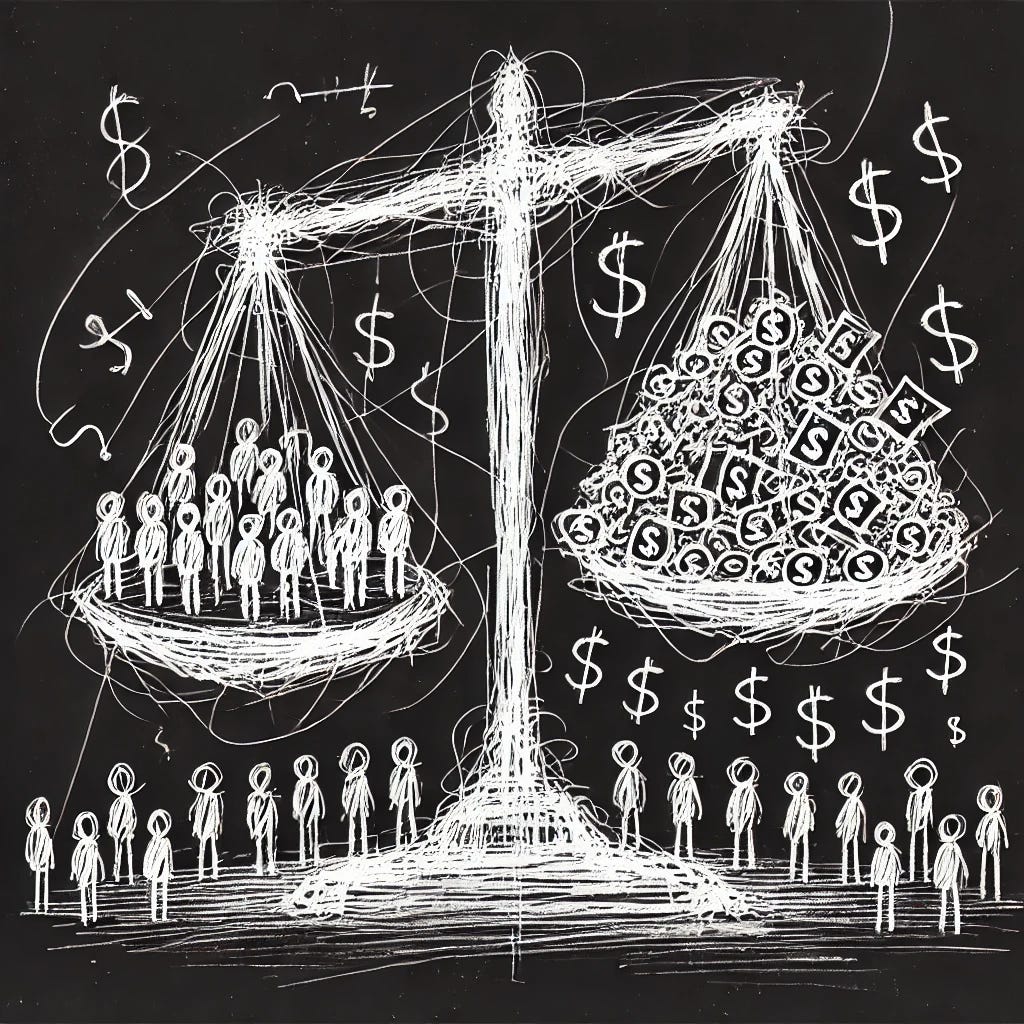

The core dilemma of the current market environment is simple: while companies are becoming more capital efficient than ever with the help of AI, venture funds are larger than ever.

Building software is now magnitudes cheaper. Thanks to AI tools like Cursor and Lovable, software engineering costs are dramatically reduced. Despite what many experienced software engineers argue, this does not only apply to prototyping but will be used at scale for building products out there. A quarter of YC’s latest batch has 95% of their code AI-written.

Software is way cheaper to build already now. Operations will follow (which is why agents are a main investment theme in 2025). In short, AI is driving the cost of software development and ops to nearly zero. In consequence, founders can reach early revenue milestones with minimal expense.

This unlocks new paths to company creation and subsequent growth scenarios. We will see a wave of smaller, capital-efficient software startups. You've likely seen some of the latest examples, like Cursor or Mercor, recently. While we tend to over-index on successful cases through survivorship bias in the media, you can see at the Lean AI Leaderboard that these are not isolated cases. Ask your trusted VC how revenue and growth KPIs have transformed in the last year, and how common decks featuring explosive growth from tiny teams have become.

New Fundraising Paths

Founders can now choose one of three paths:

Bootstrap and raise later, also now known as "Bootscaling."

Raise an early round but skip some rounds after, say "Seedstrapping".

Follow the conventional round path.

What approach should they adopt in their fundraising strategy?

The first option is currently hyped on X: Bootscaling. Founders only raise money after achieving product/market fit and proving venture-scale potential. This preserves optionality between different outcome types, avoids early dilution, and lets the team pivot freely until building conviction in a venture outcome. This isn’t entirely new (think Github or Celonis), but now teams can leverage near-zero cost of experimentation.

Option 2 is then Seedstrapping (which I called Blitzstrapping and Skipscaling before). In this scenario, the company would raise an early round like (pre-)seed, become profitable, and maintain majority ownership while growing aggressively after. They might potentially raise further growth rounds later but skip classic A rounds. This way provides initial cash for core team building, secures partnerships with VCs that might otherwise back competitors, and delivers signaling benefits (in combination with satisfying your ego). A funding from tier-1 VC still drives press coverage, recruiting, and credibility.

In a more Traditional Path, founders could also keep raising in the classic round structures of seed, A, B, etc., and deploy capital aggressively. An interesting variation of that might be High Resolution Fundraising, where founders collect smaller rounds in increments. This allows to raise in bite-size pieces as needed - almost like a ‘rolling round’ - at incrementatally higher valiations up to their Series A. They can get more great investors onto their cap table with little dilution and just enough capital to get to the next valuation milestone.

Independent of the options, a key question that founders consider is how much to raise. The amount of a fundraise rarely is a straight translation from the actual capital needs of the team. Early rounds have become very competitive, and for the most sought-after companies, the raise amount is disconnected from the actual capital needs. (As Tomasz argues, having a lower cost of capital is a competitive advantage in itself.)

Capital Deployment in the New Era

Acknowledging that many founders are able to raise more than they need, how will this excess capital be used?

Options include:

GTM war chests. But pre-PMF and with high competition on paid channels, this often proves wasteful.

Using frontier AI models rather than cost-efficient ones - accepting a worse margin structure but better product experience in the meantime with a bet of future margin improvements.

Of course, it could be used to prolong the runway.

Spending multiples on top talent

I think the smartest, and most likely, path for top founders will be the latter. Spending a multiple on what was common on each individual hire in order to attract - and even more importantly retain - the absolute best people. In my view, the best companies will stay dramatically smaller for much longer.

The optimal fundraising strategy depends on personal circumstances. Young founders with little savings but also near-zero costs can survive on minimum capital and will find bootscaling attractive, especially in lower-cost locations. Experienced or repeat founders may prefer not to raise at all, given they already have a network, personal capital, and the ability to generate revenue quickly.

The Arms Race Problem

If bootscaling is theoretically so attractive, why are we currently seeing so many experienced operator teams raising large early rounds, often with little product or distribution in place?

Understanding the game theory behind a raise helps explain it. The fundraising world is not a single-shot game but rather is played in multiple rounds. This means that fundraising decisions aren't made in isolation but as part of a strategic sequence where today's choices affect tomorrow's options. Founders must consider not just the current round but also future rounds and competitive dynamics.

Those founders who experienced the 2020-21 craziness carry scars and are adapting their strategies accordingly: "Many have heard stories of people swinging for the fences with massive valuations, only to discover the outcomes weren't nearly as successful as hoped." People learn and adjust their approach based on others' experiences.

Apart from reduced cost, AI contributes to two additional effects: For any given opportunity, there are way more teams pursuing it than ever before. And because much of the code is AI-generated, the skillset of engineering is converging to a significant degree. Both lead to a crowded, mostly undifferentiated market in the short term.

Founders, like in an arms race play, can play a lean or an aggressive fundraising strategy (raise as little as needed or raise as much as possible). And while lean is optimal individually, collectively, most founders will play aggressively in fear of being left behind if competitors are raising big.

We end in suboptimal equilibrium - for founders and employees, but similarly for investors.

VCs at the Crossroads

The fund ecosystem has exploded over the last decade, both in the amount of funds and fund sizes. Many VCs raised large funds in recent years and still need to deploy that capital in large chunks (typically seeking 10%+ ownership). We have seen multi-stage VC ‘platforms’ (like Sequoia, Accel, or GC) move upstream into earlier rounds.

With both Bootscaling and Seedstrapping becoming more common, we'll see fewer early rounds as founders pick different paths. Series-A investors, facing more missed opportunities as companies skip their rounds, will continue pushing aggressively into pre-seed. The 5-on-25 pre-seed will stay common.

Simultaneously, some founders will opt out entirely, raising minimal capital from friends, family, and strategic angels. I've already seen a comeback of true angel rounds from repeat founders, in which both angel investors and micro funds have a competitive edge as they are more flexible with ownership goals. I wouldn't be surprised, however, if we see large funds trying to entice founders to take more money early by providing secondaries even in early rounds.

Everything considered, the early stage market is and will stay a founders’ market for the time being.

This creates interesting challenges for funds. In the best case, the capital efficiency that AI promises to investors would lead to large returns on minimal capital. But considering the discussed points of further concentration in pre-seed investing, resurgent angel rounds, and valuation pressure from auction dynamics, traditional seed investors will face significant headwinds if they do not adapt their strategies.

The Value Disconnect

Perhaps most importantly, I suspect a growing disconnect between established VC value propositions and what founders actually want. Traditional VC support focused on scaling through hiring - scaling essentially meant hiring. That's precisely what today's best teams don't need or want.

We may see new partnerships formed around the contrarian yet increasingly realistic vision of staying tiny. Instead of people partners, funds might offer operating partners who help automate and optimize small teams.

The decisive factor in predicting which scenario will dominate boils down to how founders approach early rounds. Beyond logical rationales, it ultimately comes down to what becomes "cool" for founders to do.

For now, founders defying the traditional fundraising playbook remain a minority. But with the pace of change we're seeing in technology since the launch of ChatGPT, this minority could become the majority within a few quarters.

I’ll close with this quote from Fred Wilson:

But some founders are opting out of this nonsense and I do think we will see more of them do so.

It is easier than ever to bootstrap a company to sustainable operations. Some founders will do it. Others will notice. Maybe it will even become fashionable to do so.

At least one can hope.

Thanks to Judith Dada and Connor Murphy for reading drafts of this.