The Integration Myth

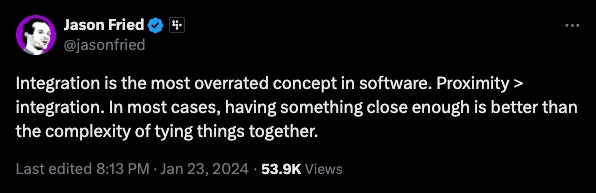

Is integration the most overrated concept in software?

25 years after the birth of SaaS, it might be time to say goodbye to the beloved business model as we're shifting to an AI-first world. It's also time to confront an uncomfortable truth: SaaS fell short of expectations in three major ways: cost efficiency, scalability, and flexibility.

The promise of seamless software integration – enabling "plug-and-play" enterprise tool stacks – has especially failed to materialize fully. The reason isn't technical shortcomings. Instead, it's a systemic issue with incentives in the SaaS model that are worth reflecting on to understand the implications for the future of enterprise software.

The Integration Promise

The vision was compelling: Every software would come with built-in APIs in the modern SaaS world, making integration between applications as simple as connecting Lego blocks. Customers could choose best-of-breed tools without the need to build custom integrations. Integrations allow them to seamlessly pipe data and automate workflows across different software tools, adapt quickly, save time, and reduce complexity.

The idea was equally an opportunity for new software startups: They could carve out parts of legacy software suites and focus on excelling in specific use cases without rebuilding adjacent functionality.

This vision shaped a generation of enterprise software. Having a set of integrations (better, a marketplace) became table stakes. VCs advised founders to focus on narrow, deep functionality. Buyers were promised they could have it all: specialized tools with seamless connections.

Reality Check

Yet, the plug-and-play promise never fully arrived: Today, we're both seeing a sharp decline in the number of applications used by enterprises and a shift of buyer demand towards all-in-one platforms.

After reaching a peak in 2022, the average number of apps per company dropped 14% within one year to 112. This number is mainly driven by larger companies, as enterprises with over 1,000 employees use approximately 150 products. The average company with 50-100 employees only uses 24 applications.

There are various reasons why we're seeing this sharp recline. The current economic environment is acting as a big accelerator, but the push of buyers to simplify tool stacks isn't new. And while consolidation might be primarily cost-driven, the cost equation includes both subscription and maintenance costs.

There are three common gaps in integrations that make maintenance costs of best-of-breed tool stacks relatively high:

One-directional syncs create data inconsistencies

Limited data flows that force manual workarounds

Incomplete workflow support that breaks processes

What's happening? Many APIs have critical gaps in functionality, limiting the value of their primary purpose of cross-tool data maintenance and workflows. This is just a symptom of a deeper problem, though, and the answer lies not in technical limitations but in fundamental market dynamics.

The Integration Incentive Problem

Three forces worked against the integration dream:

First, the narrative of the "data moat". VCs and founders internalized the idea that becoming a system of record creates a defensible competitive position. This led to an inherent reluctance to fully expose data and functionality through APIs. Unfortunately, this thinking also weakened many products' positions by limiting their ability to deeply integrate into customer workflows.

Second, the emergence of artificial walled gardens. As competition intensified and overall growth rates slowed, companies began restricting API access to potential competitors. The partnership playbook shifted from "win-win" to zero-sum thinking. This isn't irrational – it is a natural evolution as markets matured and growth became harder to find.

Third, it has been strictly rational for product teams to prioritize breadth over depth. In a world where growth trumped efficiency (even in today's market, growth is valued 2:1 over efficiency in public markets), building surface-level integrations to unlock new customer segments would always win over deepening existing integrations.

The Future of Enterprise Software

While the future is hard to predict, there are two key scenarios:

One is the rise of vertical software: Following Jason Fried's observation, we could see the rise of industry-specific platforms that own entire workflow chains, like Toast for restaurants or ServiceTitan for home services. Rather than stitching together horizontal tools, companies would use purpose-built vertical solutions. This solves the integration problem by eliminating it entirely.

The other is an AI interface future: Alternatively, LLMs and agents might finally deliver on the integration promise, not through better APIs, but by creating new interfaces between systems. Companies like Adept are already working on AI-based API interfaces or agent-based alternatives to traditional integrations.

The Integration Opportunity

We will most certainly not see an end of specialized software either. Enterprise complexity ensures that no single vendor can excel at everything. But it does mean we need new approaches.

For founders, this creates new opportunities:

Building selective alliances with truly deep integrations where others have failed

Creating vertical-specific solutions that eliminate integration needs

Developing new AI-powered interfaces between systems

For investors, it means reevaluating the conventional wisdom about moats and SaaS playbooks. The next generation of enterprise software winners will look very different from the past.

For enterprises, it means being wary about the limitations of integration promises when evaluating software. Sometimes, less integrated but more focused solutions might be the better choice.

The SaaS integration promise seems dead. But I am optimistic about what's next.

PS: Let me know what you think. Would love to hear your perspective on whether we're headed toward a vertical or horizontal future for enterprise software.