Agents: The next great unbundling

Why bundling is the latest trend for SaaS, and how agents will change that again

Like natural tides contracting and expanding, we can observe cycles in the world of venture. Today, I'm examining if the old rules of unbundling software are about to change entirely with AI agents. Instead of splitting up features, what if we could unbundle entire jobs?

As Jim Barksdale coined, "There are only two ways to make money: bundle or unbundle.1"

Explain this bundling thing again? Think of it like a combo meal. Stratechery has also written extensively on the topic.

Few talk about bundling as a strategy, yet it's crucial for understanding market dynamics and positioning startups for long-term success.

It's also a prevalent pattern used in VC. As Marc Andreessen notes: "We look actively for the pattern of large incumbent, established industry, bundled product or service offering, coupled with underlying technology change, coupled with idea for unbundled product that the customer might prefer, and then coupled with an entrepreneur who can actually build a business around that."

The big SaaS rebundling

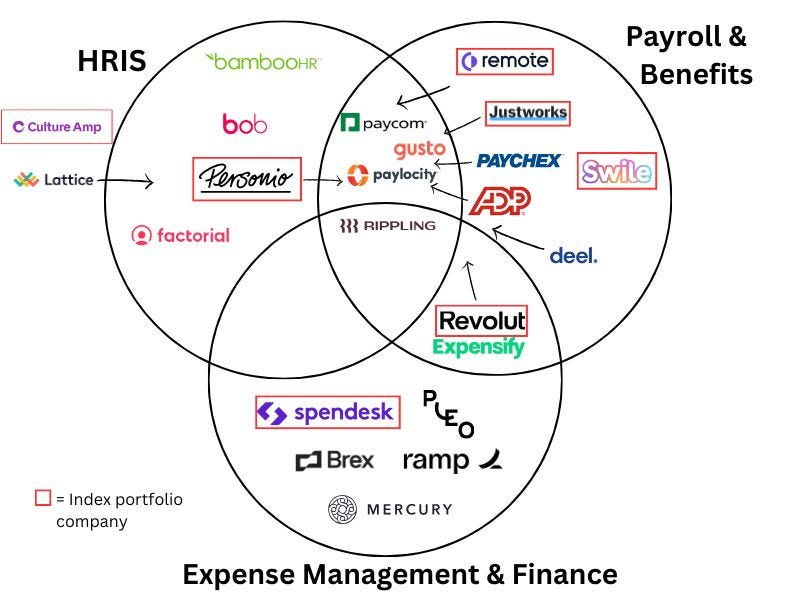

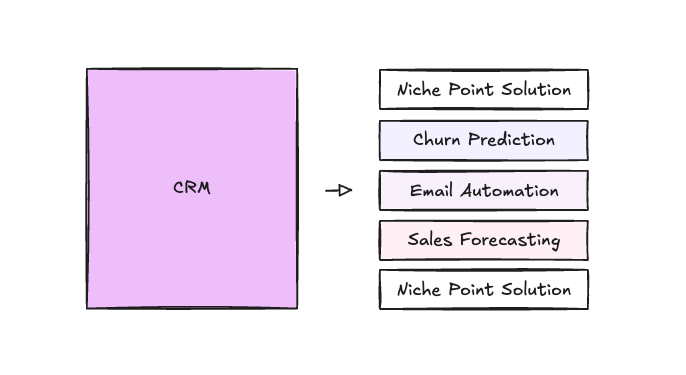

Looking back, the internet era thrived on unbundling. The same happened in enterprise SaaS, starting with Salesforce unbundling the CRM from Oracle. Workday split HR from the core. Then came the specialists - Lattice for performance, Culture Amp for surveys, and countless others for every niche relevant enough.

But now, the tide has shifted the other way. We're seeing a significant shift back to bundling as a dominant strategy.

Recent research from Contrary shows this clearly: about 80% of CFOs expressed wanting to switch to a single vendor solution with wider breadth rather than multiple-point solutions. The numbers confirm this desire. After reaching a peak in 2022, we also saw the average number of apps per company dropping 14% to 112 in 2023.

Take the back office space as an example. Point solutions are trying to transform into platforms to rebundle HR in response to vendor consolidation and pricing pressure. At the same time, existing platforms expand in adjacent spaces beyond their respective core functions.

Previously distinct categories merge towards the center.

Why? The economic climate changed. Buyers now prioritize lower complexity and cost-effectiveness over best-in-class niche solutions.

Put simply, buyers are more concerned with value than they have been before in a ZIRP world. SaaS brought many benefits to them but also fell short in key ways:

Many software solutions did not reduce work as promised, often not at all.

Integrations didn't work out as intended, adding additional maintenance costs.

As startups chased VC-worthy growth goals, the pricing of SaaS increased significantly, further weakening ROIs.

The rise of compound startups?

Rebundling works as a growth strategy. Existing platforms are taking advantage of the approach to strengthen their position, improve economics, and deliver better value.

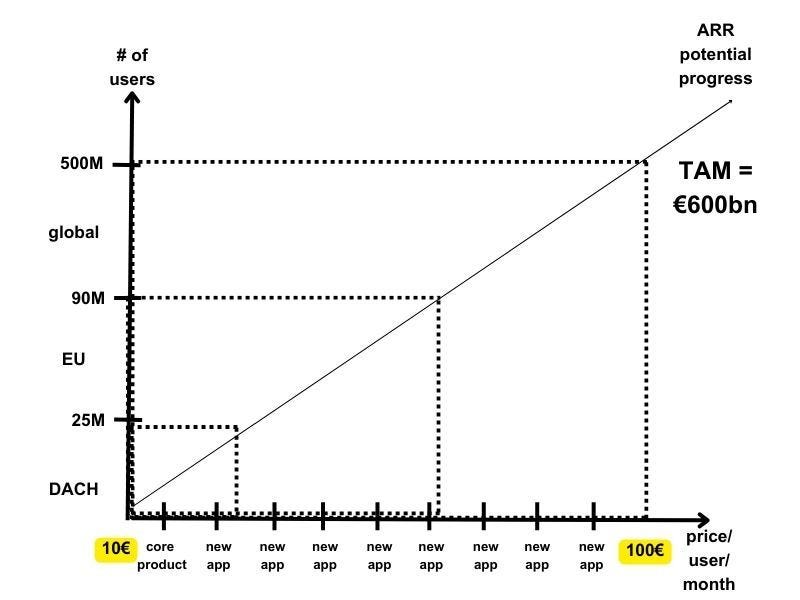

A chart I increasingly see in pitch decks - popularized by Personio - shows TAM as a function of app bundling and market expansion (usually geo, vertical, or size). Reaching $500M+ ARR looks more achievable.

Companies like Personio, Rippling, and Deel exemplify this approach. Rippling's Parker Conrad coined "compound startup" – building multiple integrated products that share resources, technology, and market insights to drive simultaneous growth across all areas.

This contradicts conventional wisdom: focus on one problem, own your niche, build an excellent point solution, expand later.

That playbook worked well in many cases. But could it be outdated? It misses opportunities for cross-department collaboration. Most niches are taken, little blue ocean remains. And transforming from single-product to multi-product company rarely succeeds.

Successfully executing the compound strategy brings clear advantages:

Distribution becomes powerful, especially when upselling new applications to existing buyers – think Microsoft and SAP. Pricing becomes an additional competitive advantage that can be achieved either through bundled pricing or economies of scale.

Products can integrate more deeply, making the whole greater than its parts. Key ingredients are the reuse of critical components and platform-wide UX patterns. This helps launch new apps faster to market, and increases adoption and satisfaction with users.

Contrary to common criticism, bundling benefits both sellers and buyers. Sellers can offer combined products at attractive prices that draw more buyers. Buyers spend less overall compared to buying separately.

Despite the advantages, we are not seeing many compound startups for now. Building multi-product from day zero demands either significant upfront capital – more common now but still rare – or a challenging later transition. While building software gets cheaper, avoiding costly growth-stage rebuilds requires deep system architecture and domain expertise.

Compound start-ups work best built natively on shared datasets – atomic units or entities. Rippling and Personio build on employee records, Salesforce on customer data. Few such opportunities exist.

Most startups must find different angles to unbundle. Could AI help unlock a new wave of opportunities by unbundling employee structures rather than software blocks?

AI's influence on the next wave

Technology changes drive bundling cycles.

The rise of cloud computing in the mid-2000s and increased availability of high-speed internet access enabled the past decade’s growth in SaaS. Over the last 18 months, enterprise software has been transformed with the emergence of Generative AI as ubiquitous technology.

Consider how challenging distribution already had become for new SaaS entrants: Traditional GTM playbooks lost effectiveness as competition intensified, ad markets became expensive, and buyers were tired of outbound emails. Founder-led content and community building have been key trends, but they are already facing similar challenges.

How does Gen-AI play into this?

First, code generation (and nascent areas like automated testing) reduces the cost of building software significantly.

Second, simplified automation further weakens GTM approaches as AI-generated noise increases.

Third, the new technology enables true end-to-end automation that was previously out of reach.

Two main AI approaches emerged so far: copilots versus agents. The destinations of each are different. Agents aim to fully own business processes, while copilots enhance employee decision-making and productivity through augmentation. Buyer preference varies by vertical and function, but end-to-end automation currently gains more traction quickly.

A new dimension for unbundling

Agents will have a significant influence on the pendulum between unbundling and bundling.

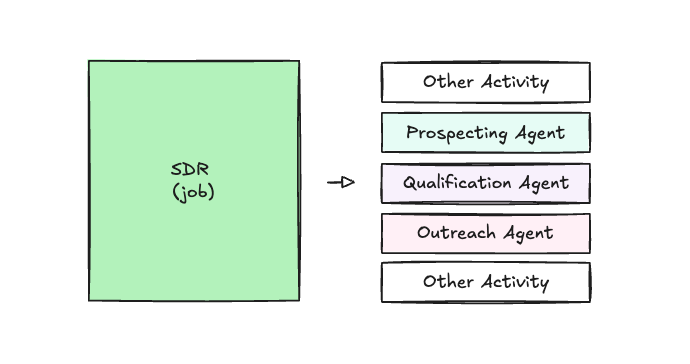

Past unbundling focused on a function dimension, splitting modules from larger systems. With agentic automation, we can now think of unbundling and rebundling at the work output level – potentially re-architecting entire jobs and teams.

Let’s look at an example. We've seen the CRM being unbundled from the ERP and after the creation of point solutions for email automation, revenue forecasting, and more. This created complex, stitched-together GTM landscapes (euphemistically, the best-of-breed stack).

Now imagine unbundling across actual employee work. Take SDRs: their job spans prospecting, outreach, and qualification (among other activities). Individual agents might handle one or multiple of these discrete activities end-to-end - see Alice from 11x.

Reversely, individual agents could also be bundled from activity to job to team level. It’s also intriguing to think how this will reshape hierarchies and team compositions in companies, but I’ll leave that for another time.

Takeaway: Unbundling is life

As Dani Rojas wisely is currently advertising, "Bundle is life." The pendulum between bundling and unbundling will continue to swing.

As AI capabilities mature and work patterns evolve, we may find ourselves moving beyond this traditional dichotomy altogether. For now, though, the majority of founders and investors will continue to prefer unbundling, and AI agents provide fresh opportunities for that.

Ideas? Working on agents? Just reply to this email!

Side note: Andreessen and Barksdale shared in an HRB interview that this was the reaction to an investor question on how Netscape would react if Microsoft were to bundle a browser into their product. What a classic investor question.